How To Determine Goodwill Donation Value

Clothing sleepwear children $1.50 clothing sleepwear men & women $2.99 clothing suit children $2.99 clothing suit men & women $9.99 clothing sweater children $2.99 clothing sweater men & women $4.99 clothing sweatshirt children $2.99 clothing sweatshirt men & women $3.99 To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores.

38 Donation Value Guide 2019 Spreadsheet in 2020 Tax

38 Donation Value Guide 2019 Spreadsheet in 2020 Tax

It is the donor’s responsibility to determine the value of donated items.

How to determine goodwill donation value. Donation value guide category item name price type. There are, however, some general guidelines that can be looked to when trying to determine the value of used books, such as how fair. Donation value guide to help you determine your donations fair market value goodwill is happy to provide a “value guide” that offers average prices in our stores for items in good condition.

Determining used goods donation value. Internal revenue service (irs) requires donors to value their items. A fair market value is a price the item would sell for on the open market.

Items must be in excellent or good condition to qualify for tax deductions. How to place a value on your donation the irs requires donors to determine the value of their donations for tax purposes. Local newspaper classified listings for the model and year of the car you've donated will provide you with a general dollar amount.

The purchase price of a business often exceeds its book value. Tax deductions for clothing and household items. You diligently got your donation receipt and filed it away with a detailed list of what you donated.

Total company net value (goodwill included) ÷ by profit should give a multiplier between 3 and 5 for companies with a total profit of around $2 million. In order to deduct more than $250 a written receipt or acknowledgement must be issued at the time of the donation. How do i determine the value of donated items?

Staple your donation receipt to this form and file with other tax documents. The common goodwill calculation method is the average of last 4 years multiplied by 4. If the donation is over $500, but does not exceed $5,000, the donor must.

These lists can be used to calculate fmv for your donated items. It’s tax preparation season, the time of year when you get rewarded for all of your efforts of having a yard sale and then donating the leftover items to charity. Charitable organizations, such as goodwill or the salvation army, provide price lists for items that they sell in their stores.

Below is a donation value guide of what items generally sell for at goodwill locations. How to value your donation. In the case of vva, the donation receipt fulfills this obligation.

The amount of the deduction for a donation of a remainder interest in real property is the fmv of the remainder interest at the time of the contribution. Thus, there is a difference of $2 million between the amount of the goodwill calculated under the two methods. How to determine the tax deduction value of donated items.

You can get the fmv by looking at similar items for sale on ebay, craigslist, or at your local thrift store. To determine the amount of your deduction for the table above, you should combine your claimed deductions for all comparable items of property donated to any charity during the year. Determining the fair market value of used books for the purpose of charitable donations is tricky because there is no formula that can be applied or definitive source on the subject.

If goodwill plans to use the vehicle, you can determine the fair market value of it based on the price of similar cars in your area. Multiply this value by the appropriate factor. One of the simplest methods of calculating goodwill for a small business is by subtracting the fair market value of its net identifiable assets from the price paid for the acquired business.

This guide is not all inclusive and may not recognize special circumstances. Assume the following items are in good condition, and remember: White house black shutters is not responsible for tax advice or assigning values.

1457 and 1458 contain these factors. If the total value of your donated items is more. Donation valuation guide the following list of typical restore items reflects a suggested range value for determining income tax deductibility.

The irs publcation 561 determining the value of donated property says that you must use a “fair market value” to determine the value of your donation. The publication is not very helpful in pricing your donated items. Prices are only estimated values.

Internal revenue service (irs) requires donors to value their items. She has over 30 years of writing and editing experience, including eight years of financial reporting, and is also a published. However, if the amount you originally paid for the item is less than the fmv, you must use the original cost of the item.

A company with a loss once in every 30 years will definitely have a goodwill value. Prices are only estimated values. Additionally, there are several online tools and services available provided by various companies and organizations.

Goodwill is an intangible asset that arises when a business is acquired by another. Your donation is valuable — to you, and to your community. To determine the fair market value of an item not on this list, use 30% of the item’s original price.

To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. Assume the following items are in good condition, and remember: Most of the time it will be the fair market value (fmv) of your item.

An easy way to help determine the selling price of your goods is to use a valuation table from a charitable organization. When you drop off your donations at goodwill, you’ll receive a receipt from a donation attendant. Charitable organizations like goodwill and the salvation army have compiled values for commonly donated.

When you give your gently used items to goodwill, you’re not only supporting an important mission. If you donate clothing, furniture, household goods or other items to goodwill, the internal revenue service allows a deduction based on the fair market value of those items. Beverly bird—a paralegal with over two decades of experience—has been the tax expert for the balance since 2015, crafting digestible personal finance, legal, and tax content for readers.bird served as a paralegal on areas of tax law, bankruptcy, and family law.

To determine this value, you must know the fmv of the property on the date of the contribution. Item men & women base price children base price shirt 2.99 1.49 sweater 4.99 2.99 sweatshirt 3.99 2.99 blazer or sport coat 4.99 If the donation is $250 or more, but does not exceed $500, a written acknowledgment of the donation must be provided by the donee.

makemebrand world blood india marketing socialmedia

makemebrand world blood india marketing socialmedia

You Can Now Fill Empty Amazon Boxes With Donations for

You Can Now Fill Empty Amazon Boxes With Donations for

Goodwill At Your Door From Your Door to Our Store! We've

Goodwill At Your Door From Your Door to Our Store! We've

Goodwill Alberta University of alberta, Goodwill, Pods

Goodwill Alberta University of alberta, Goodwill, Pods

Goodwill Alberta University of alberta, Goodwill

Goodwill Alberta University of alberta, Goodwill

Donation Value Guide 2019 Spreadsheet Lovely Goodwill

Donation Value Guide 2019 Spreadsheet Lovely Goodwill

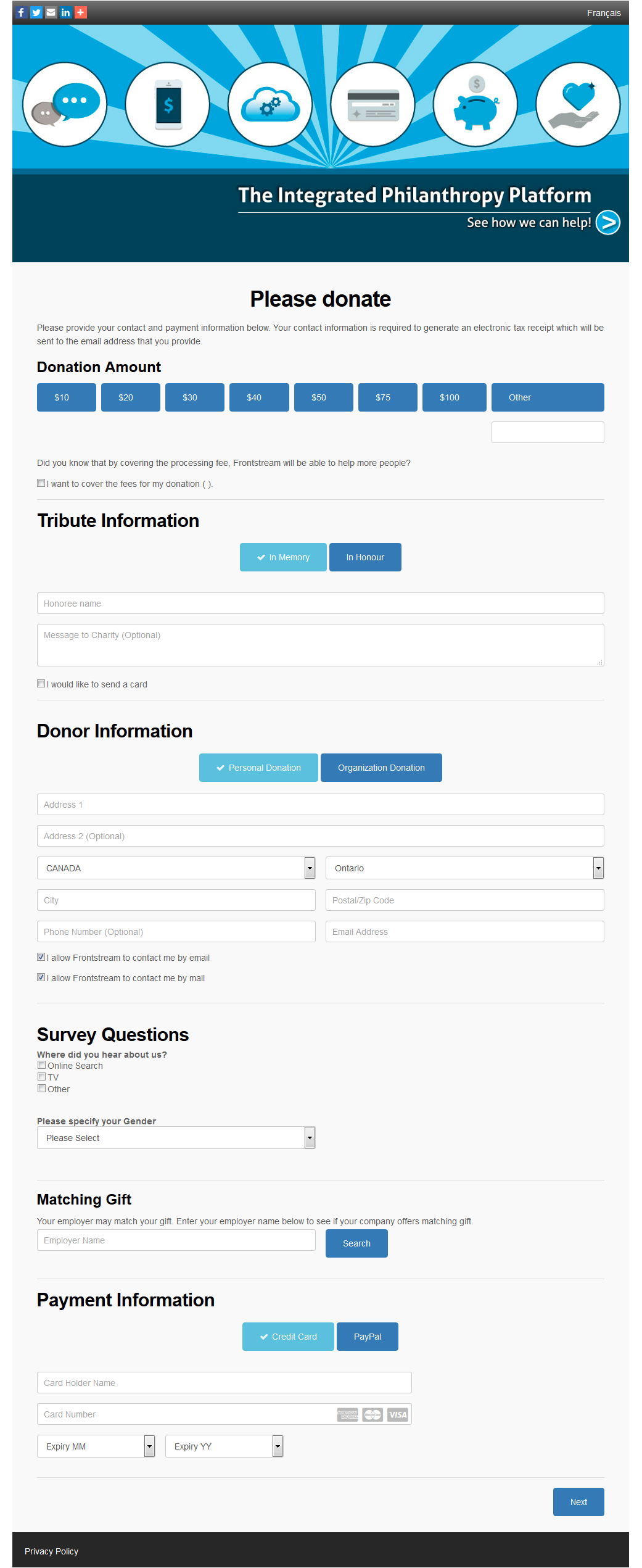

Goodwill Clothing Donation Form Template Donation form

Goodwill Clothing Donation Form Template Donation form

Lesson Before you donate your stuff to Goodwill, check

Lesson Before you donate your stuff to Goodwill, check

Pin on Festivals Greeting Cards

Pin on Festivals Greeting Cards

Everything under 20! Fashion, Goodwill store, Womens

Everything under 20! Fashion, Goodwill store, Womens

Shop Help finding a job, Goodwill industries, Shop

Shop Help finding a job, Goodwill industries, Shop

Goodwill At Your Door is expanding! We've added another

Goodwill At Your Door is expanding! We've added another

goodwill donations list Google Search Goodwill

goodwill donations list Google Search Goodwill

Pin by Stacy Larkin on Collateral Lambton, Workforce

Pin by Stacy Larkin on Collateral Lambton, Workforce