First Time Home Buyer Guide Uk

This means that at 3.75 times gross salary, buyers in the north would need to earn £20,000 a year to qualify for a mortgage, while in london it’s a whopping £67,000! You could buy a home through help to buy:

006 Property Inspection Checklist Template Fascinating

006 Property Inspection Checklist Template Fascinating

This means you will pay.

First time home buyer guide uk. This homebuyers' guide has information about how the equity loan works and how to apply. But finding out is really important, especially if you’re looking to take advantage of a first time buyer offer from a lender. Some lenders have a different definition of what a first time buyer is.

A first time buyer is usually someone who’s never owned a home before either in the uk or abroad. It varies depending on the price of the property itself. Take a look at all the schemes currently available and how they differ depending on where you’re planning on buying a home.

Shared ownership in england if: Stamp duty is a tax all home buyers must pay on properties over £125,000. The property you’re buying also needs to be where you’ll live, not something you’ll rent out or have as a second home.

Our first time buyer guide will take you through the entire mortgage process, in an easy to understand way. However, if you’ve never owned a home before, it works a little differently. This guide takes you through the process of buying your first home, including saving your deposit and applying for a mortgage.

If only it were that simple. You can find out more about shared ownership with our guide. Our tips should put you on the right track so you can figure out which options to consider to find that dream home.

First time buyer stamp duty was abolished for properties costing up to £300,000. Step by step, we’ll go from saving for your deposit right through to getting the keys to your new home. With rising london house prices, it may seem increasingly impossible to get your foot on the property ladder in the capital.

Whether you have bought a house before or are a first time buyer, buying a house is a complex process and there is a lot to consider. We wrote this guide to help you get started. First time buyer stamp duty.

As soon as you have those shiny new keys in your hands, you’ll need to keep up with a number of ongoing monthly. Our guide to buying a house has six sections that you can follow in order to get a comprehensive understanding of the entire process, from saving to moving into your new house. First time home buyer guide 11 average uk household monthly running costs water bill £35 council tax £120 maintenance and building work £50 first time home buyer guide after you move in with a new home comes new responsibilities.

7mortgagetipsfirsttimehomebuyerswestchesterny

7mortgagetipsfirsttimehomebuyerswestchesterny

Pin by Deborah O'Donnell on Home To Be in 2020 (With

Pin by Deborah O'Donnell on Home To Be in 2020 (With

How to choose the right wick for your candles? Home

How to choose the right wick for your candles? Home

11 Questions To Ask When Buying A House Moving house

11 Questions To Ask When Buying A House Moving house

How To Buy A House In The UK (Infographic) House Buy

How To Buy A House In The UK (Infographic) House Buy

Pin by MDR Home Inspections on Home Inspection Survey

Pin by MDR Home Inspections on Home Inspection Survey

How to buy a house a firsttime buyers guide Terrace

How to buy a house a firsttime buyers guide Terrace

How Olivia went from £30k to £1M in a Year Home Staging

How Olivia went from £30k to £1M in a Year Home Staging

Great tips on getting kerb appeal (With images) House

Great tips on getting kerb appeal (With images) House

Baby Step 3b Dave Ramsey Baby Steps UK Version Dave

Baby Step 3b Dave Ramsey Baby Steps UK Version Dave

Our First Home Edwardian House Little House On The

Our First Home Edwardian House Little House On The

England, Canary Wharf, Night, Lights, Canary england,

England, Canary Wharf, Night, Lights, Canary england,

Home Inventory Checklist Checklist template

Home Inventory Checklist Checklist template

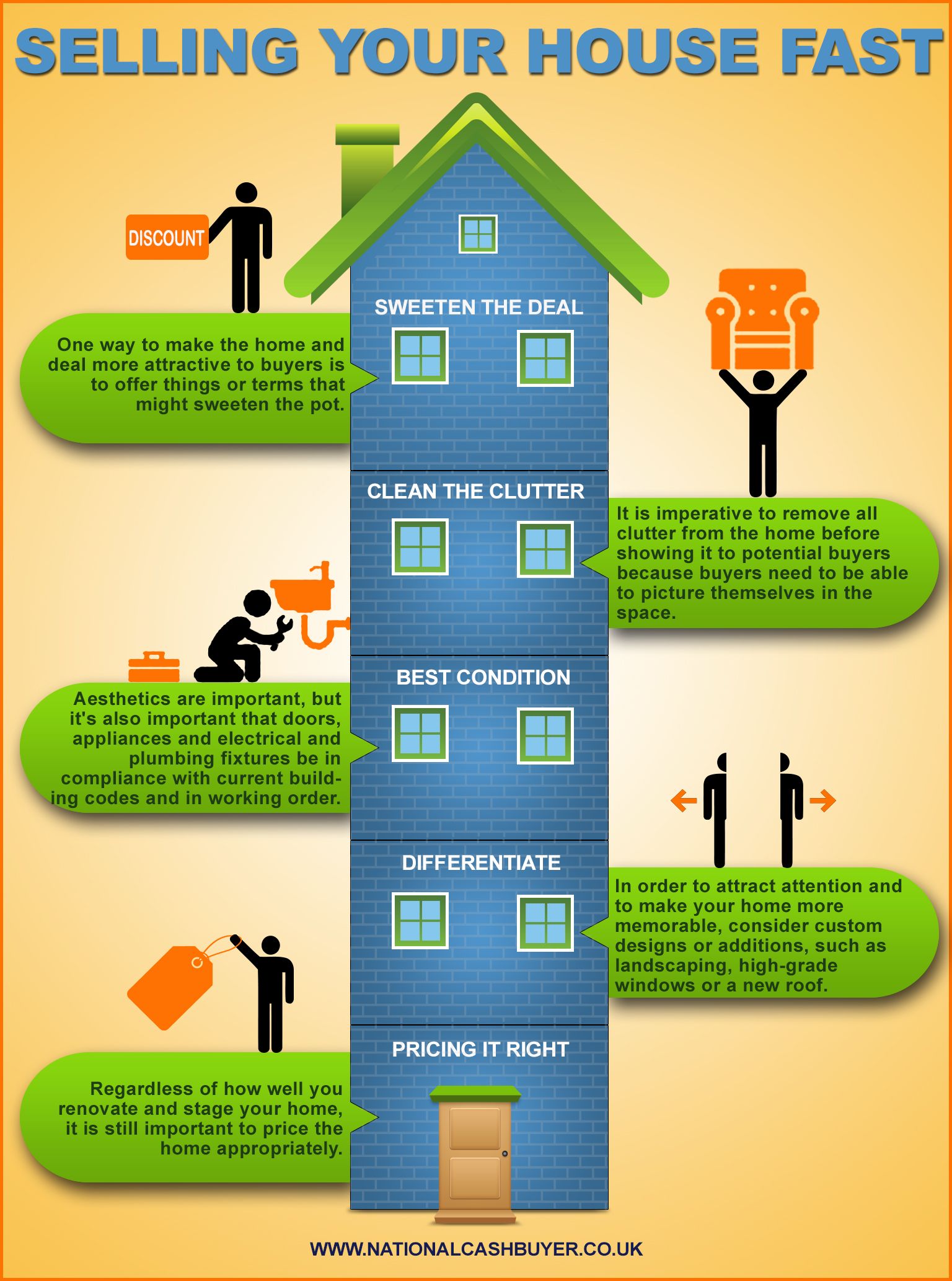

Guardian Mortgage Company Selling your house, Sell my

Guardian Mortgage Company Selling your house, Sell my

11 Questions To Ask When Buying A House in 2020 Moving

11 Questions To Ask When Buying A House in 2020 Moving

Sale Conveyancing Process Conveyancing Pinterest

Sale Conveyancing Process Conveyancing Pinterest

4 Ways to Increase your Mortgage Deposit Pay off

4 Ways to Increase your Mortgage Deposit Pay off