Donation Value Guide Jewelry

Donated jewelry items will qualify at the “fair market value” as a tax deduction. Donation value guide for 2018.

Chain necklace Chain necklace with different size and

Chain necklace Chain necklace with different size and

Old costume jewelry may seem like junk bound for a donation bin, but it can have value.

Donation value guide jewelry. The donor should use this criterion to identify potential recipients. Bed (full, queen, king) $50.00: It's now 2019 and the season to get your taxes ready for the irs.

Assume the following items are in good condition, and remember: November 16, 2015 at 12:20 pm. It includes low and high estimates.

Look for a jewelry mark. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores. To reap any benefit from charitable contributions you must itemize your deductions on your 2018 tax return.

Find fast and easy guides on how to donate cars, blood, cell phones, and other items to charities. A charity will put together a donation valuation guide to help donors take the maximum allowable charitable tax deduction.if you would like to add a charity donation value guide to this list, please send us a message. And sell help center licensing & reprints subscriber guide my.

The donation valuation guide is provided by the salvation army.these estimations are based on the average price for the items in good condition. It is funny how we feel obligated to hold onto things for sentimental value. Guide for goodwill donors the u.s.

Donation town has compiled a list of charitable donation value guides that charities across the country have published. Things like jewelry, artwork, paintings, and antiques almost always require appraisals. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill® stores.

The online guide to donations! Valuation guide for goodwill donors the u.s. Donation value guide category item name price type.

Internal revenue service (irs) requires donors to value their items. You'll need this information along with the value of your items for the irs at tax time to claim your deduction. Clothing sleepwear children $1.50 clothing sleepwear men & women $2.99 clothing suit children $2.99 clothing suit men & women $9.99.

The amount of the deduction for a donation of a remainder interest in real property is the fmv of the remainder interest at the time of the contribution. You probably won’t find them on any charity’s published list of approximate values, either. These estimations are based on the average price for the items in good condition.

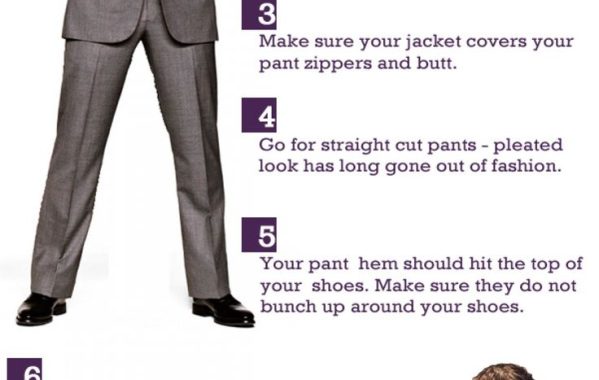

Please choose a value within this range that reflects your item's relative age and quality. Donation value guide the council shop. Throughout the year, as you clean out your closets, remember to make an itemized listing of the donations you give to charity.

Multiply this value by the appropriate factor. Internal revenue service (irs) requires donors to value their items. If it is taking up space, have someone else enjoy while potentially raising money for a good cause.

Donation valuation guide the following list of typical restore items reflects a suggested range value for determining income tax deductibility. The united states internal revenue service (irs) requires donors to value their items. Prices are only estimated values.

The donation valuation guide is provided by the salvation army. To claim any charitable gifts or contributions, whether it be a big ticket item like a car or a box of clothes, it will probably only be a. You will get the necessary tax documentation for your jewelry donation and a receipt from one of our four charities immediately upon acceptance.

You will have all the information you need. Bank rate they have lists of commonly donated items and their typical values.… If you donate clothing, furniture, household goods or other items to goodwill, the internal revenue service allows a deduction based on the fair market value of those items.

No charity can give you a tax deduction value at all unless your donation sells, is gifted to another nonprofit or needy individual, or the charity determines that they will retain the item to utilize in the furtherance of their. In order to deduct more than $250 a written receipt or acknowledgement must be issued at the time of the donation. 1457 and 1458 contain these factors.

With costume jewelry, donation is a really good option. To determine this value, you must know the fmv of the property on the date of the contribution. Assume the following items are in good condition, and remember:

Jewelry, gems, paintings, hobby collections, etc. Fair market value is the price at which property changes hands between a willing buyer and a willing seller. Women's clothing tops bottoms shorts shoes jackets i coats fur coats dressesl suits handbags jewelry computermonitor men's clothing tops bottoms shoes shorts jackets i coats suits children's clothing tops bottoms shoes low $3 $8 $5 $8 $10 $25 $10 $8 $5

This guide is not all inclusive and may not recognize special circumstances.

Silver Toned Etched Mathematical Greek Sigma Symbol

Silver Toned Etched Mathematical Greek Sigma Symbol

Pin on Stella & Dot Personal Faves

Pin on Stella & Dot Personal Faves

Pin by One Thing Lockets on Customized Message Locket

Pin by One Thing Lockets on Customized Message Locket

ALEX AND ANI Spirit Of The Eagle CHARITY BY DESIGN

ALEX AND ANI Spirit Of The Eagle CHARITY BY DESIGN

Transformers pendant necklace Necklace, Pendant necklace

Transformers pendant necklace Necklace, Pendant necklace

©️ rijksmuseum Gold mounted Cameo Brooch, with fine pearl

©️ rijksmuseum Gold mounted Cameo Brooch, with fine pearl

FOR CHARITY beaded bracelets Artisan handmade

FOR CHARITY beaded bracelets Artisan handmade

Made this piece as a donation for the Charity Ally

Made this piece as a donation for the Charity Ally

Pin by Stella & Dot VIP KBrand on Misc. Awesomeness in

Pin by Stella & Dot VIP KBrand on Misc. Awesomeness in

Costume jewelry lot vintage and modern random mix I buy

Costume jewelry lot vintage and modern random mix I buy

A personal favorite from my Etsy shop

A personal favorite from my Etsy shop

Pin by nella on jewelry in 2020 Gold bar earrings

Pin by nella on jewelry in 2020 Gold bar earrings

Charity by Design, Elephant ii Bangle Bracelet Everybody

Charity by Design, Elephant ii Bangle Bracelet Everybody

100 to Animal Charity Pendant Necklace Dog PAWSITIVE PUP

100 to Animal Charity Pendant Necklace Dog PAWSITIVE PUP

'You're So Loved' Gold Plated Necklace (With images

'You're So Loved' Gold Plated Necklace (With images

Pin on Choker Necklaces from the URBANE IMPRINT Jewelry

Pin on Choker Necklaces from the URBANE IMPRINT Jewelry

SAVE THE BEES! Charity Bee Necklace! SOON) 🐝SAVE

SAVE THE BEES! Charity Bee Necklace! SOON) 🐝SAVE